Introduction to Indian Coffee

India has cultivated coffee for over three centuries, establishing a respected position in the global coffee trade. Most Indian coffee is shade-grown and often intercropped with spices such as cardamom, pepper, and cinnamon. These practices impart distinctive flavors to the beans while supporting sustainable agriculture and biodiversity.

Today, India is among the top coffee exporters in Asia, with a reputation for producing both Arabica and Robusta beans of exceptional quality. Indian coffee enjoys a strong presence in Europe—particularly in Italy, Germany, and the UK—as well as in markets like the United States, Canada, and Australia. What sets it apart is not just the variety of beans but the unique processing methods, such as the famous Monsooned Malabar, which transforms the flavor profile through exposure to monsoon winds.

With increasing emphasis on quality, sustainability, and traceability among consumers, Indian coffee is attracting a new wave of admirers. Yet, what risks do importers, roasters, and coffee enthusiasts face if Indian coffee remains overlooked? From missing out on its rich regional flavors to losing a competitive edge in the growing specialty coffee market, the stakes are high. Its blend of tradition and innovative growth positions Indian coffee as an enticing option for those eager to expand their offerings. To start sourcing Indian coffee, potential buyers can contact exporters like SB Global Ventures directly to better understand the unique offerings available.

Major Indian Coffee Varieties

India’s coffee landscape is diverse, offering a mix of traditional and specialty beans that cater to a wide range of international buyers. Each variety has its own story, cultivation style, and flavor profile, making Indian coffee appealing to both bulk importers and specialty roasters.

Traditional Indian Coffees

India’s coffee production is anchored in two main species — Arabica and Robusta. Together, they form the backbone of India’s coffee exports, with Arabica prized for its delicacy and Robusta valued for its strength and body.

Indian Arabica Coffee

Arabica, grown primarily at higher elevations in Karnataka, Kerala, and Tamil Nadu, is known for its mild taste, lower caffeine content, and subtle aromas. It is particularly valued in markets such as the US, Germany, and Italy, where lighter roasts are preferred.

Indian Robusta Coffee

Robusta accounts for a larger share of India’s coffee exports, thanks to its high yield, bold taste, and strong body. Grown at slightly lower elevations, Robusta beans from India are favored in Italy and other parts of Europe for making traditional espresso blends. Their naturally higher caffeine content and earthy flavor give them a robust character, making them essential for roasters looking for strength and crema in their coffee.

Indian Specialty Coffees

In recent years, India has emerged as a serious player in the specialty coffee segment. Farmers and cooperatives in regions like Coorg, Chikmagalur, Araku Valley, and Wayanad are producing traceable, single-origin coffees that highlight terroir and innovative processing methods such as honey, natural, and anaerobic fermentation.

Monsooned Malabar Coffee

Amidst the rhythmic patter of monsoon rains, Indian Monsooned Malabar coffee beans, also known as Indian monsooned coffee, undergo a unique and captivating transformation. Imagine beans laid out on expansive, open-air warehouses, the air swirling with ocean-salt infused breezes that blend with the earthy aroma of wet earth and foliage. Here, the coffee beans soak up the monsoon winds and humidity over several weeks, swelling from their initial green to a rich, straw-gold color. This process not only alters their appearance but also develops a smooth, mellow flavor with low acidity, reminiscent of the caress of gentle rain on parched land. This distinct coffee, with its evocative sensory journey, is in high demand in Scandinavian countries, Germany, and the UK, cherished for its unique taste and use in specialty blends.

Kaapi Royale

Known for its intense body, low acidity, and rich cocoa undertones, Kaapi Royale is sometimes referred to as “India’s answer to fine specialty Robusta.” It has earned recognition among European espresso roasters, particularly in Italy and Germany, where it is blended into high-end espressos for its thick crema and smooth finish. The limited availability of Kaapi Royale makes it a sought-after product, commanding a premium price in auctions and exports.

Mysore Nuggets Extra Bold

Among South Indian coffees, Mysore Nuggets Extra Bold holds a special place. These are the largest and highest-grade Arabica beans grown in Karnataka, often considered the benchmark for quality Indian Arabicas. Each bean is bold, uniform, and hand-sorted to ensure only the best make the cut.

In the cup, Mysore Nuggets deliver a smooth, mild flavor with delicate acidity, balanced body, and subtle hints of chocolate and spice. This makes them highly versatile—equally suitable for filter coffee, espresso, and blends. Globally, Mysore Nuggets are recognized as one of the best Indian coffee beans, often used by roasters in Europe and North America who want to highlight India’s Arabica potential. For importers, sourcing Mysore Nuggets offers both consistency and a story rooted in the heritage of South Indian coffee estates.

Emerging regions are also stepping into the spotlight:

- Odisha has started producing high-quality Arabica in the Koraput district, where altitude and cool climate give beans fruity and floral notes.

- North Eastern states like Nagaland, Manipur, Mizoram, Arunachal Pradesh, Meghalaya, and Assam are attracting international buyers with their small-batch specialty lots. These coffees stand out for their clean cup profiles, bright acidity, and unique flavors, often linked to the region’s rich biodiversity and traditional farming methods.

These developments position India not only as a bulk exporter of Arabica and Robusta but also as a source of innovative, high-scoring specialty coffees that are gaining ground in third-wave markets in the US, Europe, and Australia.

Unique Features of Indian Coffee

While many countries produce coffee on a large commercial scale, India stands out for its distinct cultivation practices and natural advantages. These unique features not only define the character of Indian coffee but also make it highly attractive in global markets.

Shade-Grown Cultivation

Unlike the sun-drenched plantations common in Latin America and Africa, most Indian coffee is cultivated under a two-tier shade system. Tall evergreen trees provide the upper canopy, while fruit and spice plants form the lower layer. This method protects the coffee plants from harsh sunlight, conserves soil moisture, and supports biodiversity. Shade-grown coffee is often linked with richer flavors and smoother acidity, giving Indian beans a unique edge in international markets.

Intercropping with Spices

A hallmark of Indian plantations is the practice of intercropping coffee with spices such as cardamom, pepper, cinnamon, and cloves. This not only provides farmers with an additional income stream but also imparts subtle aromatic undertones to the beans. Many buyers and roasters believe that these intercropped plantations are what give Indian coffee its distinctive spicy, earthy flavor profile—something not commonly found elsewhere.

Sustainability and Biodiversity

Indian coffee is frequently praised for being eco-friendly and sustainable. Shade trees, spice crops, and natural vegetation create a habitat for birds and wildlife, making many coffee estates hotspots of biodiversity. Increasingly, producers are moving towards organic certification and sustainable farming practices, aligning with the demands of eco-conscious consumers in markets like Germany, the UK, and North America.

Diverse Processing Methods

In addition to the traditional washed and natural methods, India is experimenting with innovative processing styles such as honey, anaerobic fermentation, and carbonic maceration—particularly in specialty-growing regions like Araku Valley and the North East. These methods add variety to the flavor spectrum and appeal strongly to third-wave coffee roasters who are always looking for unique cup profiles.

Distinct Flavor Profiles

The combination of altitude, shade, soil, and intercropping means Indian coffee is known for its low acidity, medium body, and smooth flavor, often carrying hints of spice, nuts, and chocolate. Specialty lots can also feature bright fruitiness and floral notes, especially from higher-altitude Arabica regions. This diversity allows Indian coffee to cater to everything from espresso blends in Italy to single-origin pour-overs in the US and Australia.

Key Coffee-Growing Regions in India

India’s coffee production is shaped by its geography, climate, and cultural diversity. Each region contributes unique characteristics, resulting in a broad spectrum of flavors that appeal to international buyers. While the southern states remain the backbone of production, emerging regions in Odisha and the North East are also carving a space in the specialty market.

Karnataka – The Coffee Heartland

Karnataka produces nearly two-thirds of India’s coffee, making it the largest contributor. The regions of Coorg, Chikmagalur, and Hassan are famous for high-quality Arabica and Robusta beans. Coorg’s Arabicas are known for their balanced acidity and sweet, nutty notes, while Chikmagalur’s estates often produce beans with chocolatey depth that work beautifully in espresso blends.

Kerala – Wayanad and Beyond

Kerala, particularly the Wayanad district, is another important coffee hub. Here, farmers cultivate both Arabica and Robusta, with Robusta being more dominant. Wayanad Robusta is appreciated for its bold, full-bodied flavor, making it popular in Italian espresso blends. Kerala’s smallholders are also experimenting with organic and sustainable farming practices, adding appeal for eco-conscious buyers.

Tamil Nadu – The High-Elevation Plantations

Tamil Nadu’s coffee is grown mainly in the Nilgiris, Shevaroy Hills, and Pulney Hills, where the higher altitudes favor Arabica cultivation. These beans often show bright acidity and floral notes, making them well-suited for specialty roasters in Europe and North America. Tamil Nadu is also known for shade-grown practices, intercropped with spices and fruits, which add to the unique aroma.

Andhra Pradesh – The Araku Valley

The Araku Valley, located in the Eastern Ghats, is gaining worldwide recognition for its tribal cooperative-led specialty coffee. Produced at elevations of 900–1,200 meters, Araku coffee often features fruity and wine-like notes, placing it in demand with third-wave roasters. The emphasis on organic cultivation and community-driven models adds social and ethical value, making Araku coffee highly marketable in Europe and the US.

Odisha – The Koraput Region

Odisha’s Koraput district has emerged as a new hotspot for Arabica coffee. The region’s climate and soil conditions produce beans with clean, fruity flavors that are increasingly catching the attention of specialty buyers. As production expands, Koraput is expected to become a strong contributor to India’s specialty coffee reputation.

North East India – A Rising Frontier

The North Eastern states—including Nagaland, Manipur, Mizoram, Arunachal Pradesh, Meghalaya, and Assam—are new players in Indian coffee but are quickly gaining recognition. These regions, with their cool climate and fertile soils, produce coffees marked by bright acidity, floral tones, and clean cup profiles. Smallholder farmers and cooperatives are driving this growth, and their beans are finding niche markets in Japan, Europe, and North America.

Indian Coffee in Global Markets

India’s coffee export story is robust and evolving. Beyond the well-established demand in the US, Europe, and Australia, there’s a detailed landscape of export volumes, buyer preferences, and emerging trends shaping how Indian coffee is perceived globally.

Export Volumes & Major Buyers

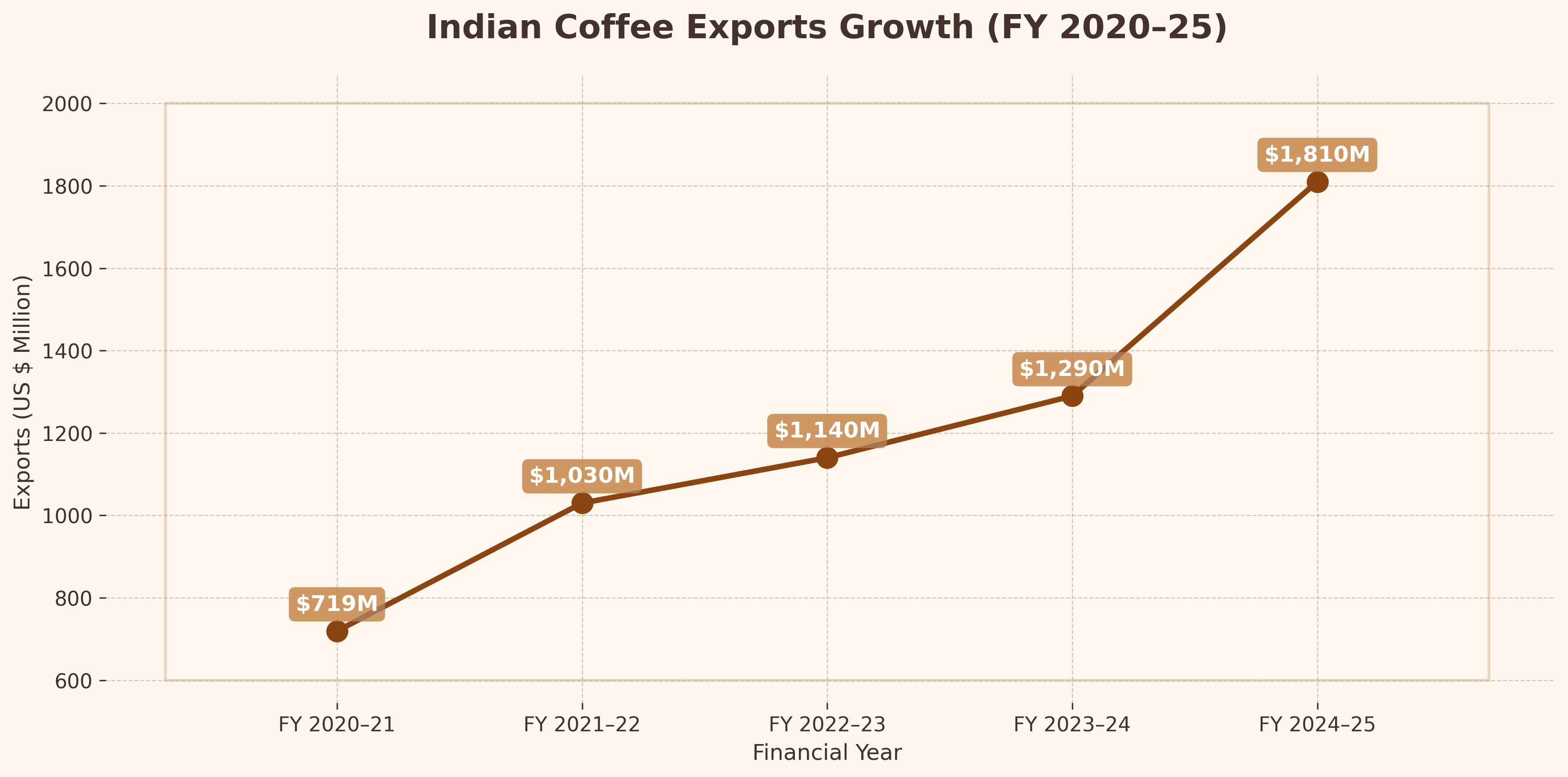

In FY 2024–25, India’s coffee exports reached US $1.81 billion, recording a growth rate of over 40% from the previous year, fueled by rising global demand for both Robusta and specialty coffees. Over the last decade, exports have more than doubled — from US $800 million in 2014–15 to US $1.81 billion in 2024–25 — highlighting India’s growing importance in global coffee trade.

Global Market Demand Highlights

- United States, Canada & Australia: These markets are increasingly drawn to Indian specialty and single-origin coffees. As interest in unique, traceable beans grows—especially among third-wave roasters—India’s specialty segments, like those from Araku Valley, Coorg, and the North East, are seeing rising demand.

- Europe (Italy, Germany, UK): Long-standing lovers of Indian coffee, European markets continue to value its versatility—from espresso blends in Italy to distinctive Monsooned Malabar profiles favored in Germany and the UK.

- Middle East & Asia: The UAE and other Middle Eastern hubs often act as regional distribution centers, while countries like South Korea and Japan are showing rising interest in specialty and sustainably-grown Indian coffee.

Top Export Destinations (Based on Latest Data)

- Italy leads with approximately 19.0% of India’s coffee exports.

- Germany follows at 12.4%.

- Russia and Belgium both account for around 5.8% respectively.

- UAE holds roughly 5.6% of the export share.

- United States is at about 4.1%.

By Tonnage (2023 shipment snapshot)

- Italy: 55,546 tonnes

- Germany: 35,877 tonnes

- Russia: 27,455 tonnes

- Belgium: 19,079 tonnes

- UAE: 18,124 tonnes

- Poland: 15,679 tonnes

- Libya: 13,022 tonnes

What Types Are Being Exported?

India’s export mix spans multiple formats and coffee types:

- Green beans (unroasted): Around 70–75% of exports consist of Arabica and Robusta, mostly shipped in raw form.

- Instant coffee and other value-added products Account for roughly 25–30% of exports, especially popular in markets like Russia and Turkey.

- Robusta is clearly driving recent export growth: In Q1 2024, Robusta shipments jumped 18%, while Arabica was flat or slightly down.

- Indian Premium Arabica: Parchment also continues modest growth, reflecting specialty demand.

Regional Preferences & Trends

- Europe: Italian espresso blends lean toward strong-bodied Robusta and Monsooned Malabar. Specialty Arabica from Coorg, Araku, and the North East are gaining traction in Germany and UK artisan cafés.

- Middle East & Russia: Instant coffee and robust blends remain highly favored for their convenience and consistent flavor in retail and hospitality segments.

- USA & Canada: Growing interest in single-origin, traceable specialty lots—especially Araku and North East micro-lots.

- Emerging trends:

- Karnataka’s coffee exporters saw a 60% surge in shipment value in 2024–25, thanks to record prices and smoothed export logistics.

- However, in 2025, exports are projected to decline over 10% due to a drop in production (374,200 tons harvested in 2023/24) and low carryover stocks—despite sky-high prices.

Summary Table: Export Destinations & Product Types

| Region / Country | Export Share / Role | Most-Sold Coffee Formats |

|---|---|---|

| Europe (Italy, Germany, Belgium) | ~50% total exports | Green Robusta, Monsooned Malabar, Specialty Arabica |

| Russia & UAE | 5–6% each | Instant coffee, Robusta blends |

| United States & Canada | ~4–5%, growing specialty demand | Traceable single-origin Arabicas |

| Karnataka-origin coffee | Export driver (noted value surge) | Mix of formats, incl. premium and bulk |

These numbers reinforce the strategic importance of Europe—especially Italy and Germany—as flagship markets, while also highlighting expanding interest from the Middle East, Russia, and, modestly, North America.

Trends in Indian Coffee Exports

The Indian coffee industry is in a phase of transformation, driven by global market dynamics, evolving consumer preferences, and domestic shifts in production. Several key trends are shaping the trajectory of exports:

- Rising Demand for Robusta: Robusta has powered recent export growth, especially for espresso blend needs in Europe. Its body and dark-cocoa finish make it attractive for bulk buyers.

- Specialty Coffee Growth: Monsooned Malabar, Araku Valley micro-lots, Koraput Arabica, Kaapi Royale, and North East coffees are capturing attention in specialty markets across the US, UK, Japan, and Australia.

- Diversification of Export Markets: While Europe remains dominant, markets like the Middle East, South Korea, and Southeast Asia are emerging. Instant coffee demand is particularly high in Russia, Turkey, and the UAE.

- Value-Added Exports: India is exporting more roasted and instant coffee—boosting export value and capturing a larger share of the coffee value chain.

- Transparency & Certifications: Global buyers increasingly demand traceability and certifications (Fair Trade, Organic, Rainforest Alliance). Indian exporters are adopting traceability systems and sustainability practices in response.

Certifications & Quality Standards

Global buyers, especially in Europe and North America, are now demanding transparency and certifications. The most sought-after certifications include:

- Fair Trade Certification: Ensures ethical standards and better prices for farmers and workers.

- Organic Certification: Verifies production without synthetic fertilizers or pesticides.

- Rainforest Alliance Certification: Focuses on biodiversity preservation and sustainable land use.

By prioritizing these certifications, Indian exporters can enhance their market appeal and cater to eco-conscious consumers.

Opportunities and Challenges for Indian Coffee Exporters

India’s coffee industry has immense potential on the global stage, but exporters must navigate a landscape that offers both unique opportunities and pressing challenges.

🌍 Opportunities

- Growing Global Coffee Consumption: Coffee demand worldwide continues to rise, particularly in Asia-Pacific and North America. Exporters can supply both bulk Robusta and premium specialty Arabicas.

- Premiumization & Specialty Coffee: Regions like Araku Valley, Koraput, and the North East can meet specialty demand and secure higher margins.

- Value-Added Exports: Instant coffee and roasted products are growing—especially in Eastern Europe and the Middle East.

- Sustainability as a Differentiator: Shade-grown and intercropped coffees can attract eco-conscious buyers.

- Building Trust Through Digital Presence & Brand Value: Exporters who invest in storytelling, traceability, and digital marketing can build long-term buyer relationships. Merchant exporters like SB Global Ventures focus on curating specialty lots and providing traceable supply.

⚠️ Challenges

- Climate Vulnerability: Erratic monsoons, dry spells, and pests threaten yield consistency.

- Price Volatility: Global coffee prices can rapidly change, impacting margins for exporters and buyers.

- Stiff Global Competition: Brazil, Vietnam, and Colombia dominate global exports, making differentiation and branding critical for India.

- Limited Domestic Branding: Much coffee is still exported as raw beans without strong national branding in specialty markets.

- Supply Chain & Logistics: High shipping costs, port delays, and infrastructure issues can affect competitiveness. Exporters can mitigate these by partnering with logistics providers and leveraging export facilitation programs.

Exporters looking to stand out should focus on building direct trade relationships with international roasters, pursuing relevant certifications, investing in quality control and processing facilities, and strengthening digital channels to reach niche buyers.

Conclusion

India’s coffee story is as diverse as its landscapes—from bold South Indian Robustas and Kaapi coffee to the nuanced Arabicas of Araku and the North East. With a growing international appetite for specialty coffee, sustainable farming, and value-added exports, India stands at the threshold of becoming a stronger player in the global coffee market.

At the same time, exporters must navigate climate challenges, price volatility, and stiff competition from established producers like Brazil and Vietnam. The way forward lies in differentiation, sustainability, and storytelling, positioning Indian coffee not just as a commodity, but as an experience rooted in heritage, biodiversity, and craftsmanship. Merchant exporters like SB Global Ventures play a crucial role in this ecosystem by sourcing high-quality coffee directly from estates and Coffee Board auctions, ensuring international buyers receive traceable, premium beans while benefiting from professional export handling.

To achieve this, exporters can adopt practical export strategies such as building direct trade relationships with international roasters, which can reduce reliance on traditional middlemen and increase margins. Investing in certifications like Fair Trade and Organic can enhance the credibility and appeal of Indian coffee in premium markets. Leveraging digital platforms and B2B marketplaces can also help exporters reach niche buyers across the globe, facilitating direct communication and better market access. Will you be the visionary roaster who brings India's next iconic blend to the world stage, transforming curiosity into commitment?

For businesses and exporters, this means focusing on quality, certifications, branding, and new markets while leveraging India’s unique strengths. As global coffee culture evolves, Indian coffee has the opportunity to claim a bigger share of the cup.

Frequently Asked Questions (FAQ)

India primarily produces Arabica and Robusta, with specialty offerings like Monsooned Malabar, Araku Valley Arabica, Kaapi Royale, and emerging coffees from Odisha and the North East.

In 2024, major buyers included Italy, Germany, Russia, Belgium, UAE, and Poland, with Europe accounting for the largest share. Demand is also rising in the US, Canada, Australia, and Japan.

Indian coffee is often shade-grown alongside spices like cardamom and pepper, giving it distinctive flavor notes. Processes like monsooning (used for Monsooned Malabar) further enhance uniqueness.

Yes. Specialty roasters in North America, Europe, and East Asia are increasingly sourcing Indian coffees for their traceability, flavor profiles, and sustainable farming practices.

Buyers can work with merchant exporters like SB Global Ventures, who procure coffee directly from estates and Coffee Board auctions, ensuring consistent quality, traceable supply, and professional export logistics.

Key challenges include climate change, global price fluctuations, competition from Brazil and Vietnam, and limited branding in specialty markets.

By focusing on traceable sourcing, certifications (Organic, Fair Trade), and value-added formats like roasted and instant coffee, exporters like SB Global Ventures help buyers access premium, high-quality Indian coffee with reliable delivery.

SB Global Ventures specializes in sourcing coffee from multiple estates and auctions across India, offering both bulk and specialty lots. By ensuring quality, traceability, and professional export handling, we provide international buyers with a reliable, one-stop solution for premium Indian coffee.

It undergoes a rare “monsooning” process where beans absorb humidity and coastal winds, developing a smooth, mellow flavor with low acidity.

A premium washed Robusta from South India, known for its heavy body and chocolatey notes—highly valued in espresso blends.

Very—instant coffee accounts for ~25% of exports, especially in Russia, Turkey, and Middle Eastern markets.